The Spanish toy industry began to take off in the first decades of the twentieth century in the Comunidad Valenciana (Valencian Community) and Cataluña (Catalonia), where today more than 70% of the country’s toy manufacturers are located. More recently, globalisation, competition with products imported from China, the economic recession and the emergence of electronic toys have been major challenges for a sector that has put quality and product design as its international forefront.

Quality vs Quantity

Committing to a well-designed and high-quality product has proved to be the most effective way of competing with China, the world’s largest toy manufacturer. 95% of the Spanish toy industry is composed of small and medium companies. It has managed to place its products in markets across the world, which account for 40% of its sales on average, however some companies substantially exceed this percentage.

As such, 60% of the sales from companies such as Famosa come from exports to more than 50 countries. It manufactures the leading dolls in the Spanish sector and top-sellers abroad such as Nenuco or Nancy, and brands such as Feber, dedicated to battery-powered vehicles, baby walkers, playhouses and slides, and has subsidiaries in Portugal, France, Italy, Mexico, Puerto Rico and China. IMC Toys products, especially the licensed small toys, as well as own brand products reach 72 countries, with an international turnover of 80%; like Injusa, a specialist in large wheeled and outdoor toys. Educa Borrás, the oldest company in the Spanish sector –formed in 1894–, dedicated to educational games and puzzles, exports 45% of its production to 90 countries.

The Spanish toy industry, 95% of which is composed of small and medium companies, has managed to place its products in markets across the world

Even smaller companies –some whose products are practically handmade– have reached international markets. For example, in the case of Muñecas Arias, which sells its products to 25 countries across America and Europe, or Trompos Space, a family business located in Domeño, a small village in Valencia: established in 2005, it has turned the traditional wooden spinning top into a sophisticated design toy that includes accessories such as rotating tips or fluorescent ropes and is sold in Holland, Poland, Germany and the United States.

Another success story is of Imaginarium, a company founded in Zaragoza in 1992, it doesn’t have factories but does have its own brand and design that is sold in its shops, of which more than half are franchises. It currently trades at more than 380 retail locations in almost 30 countries and is listed on the Spanish alternative investment market. It is possible to find Imaginarium shops in Bahrain, Hungary, Qatar and Hong Kong.

A ‘Silicon Valley’ of toys

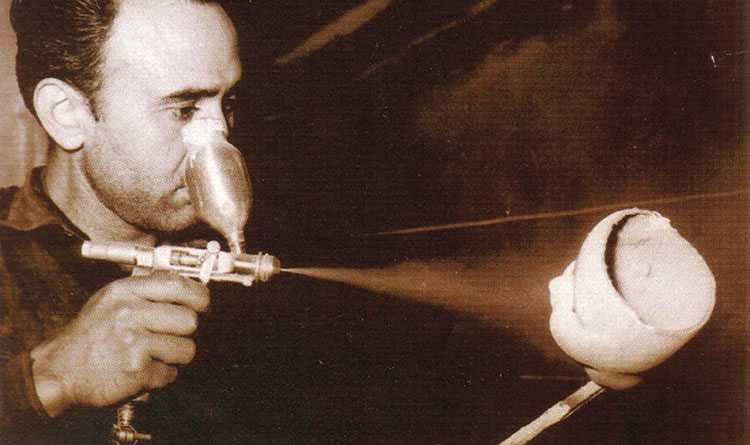

- Spanish toy manufacturers, traditionally exporters, are investing in marketing and R&D to compete in the international markets. Thus, the Instituto Tecnológico del Juguete (research centre specializing in toys), promoted by the manufacturers’ association, can be found in the same place where the first car and doll production workshops started in the 50’s. It is located in Ibi (03), in the province of Alicante, that together with the municipalities of Onil, Biar, Tibi and Castalia form part of the so-called “Valley of Toys”, due to the concentration of toy manufacturing firms in the region.

- At the centre, which covers 4,500 m2, 70 experts in various fields analyse and test all kind of products, to not only guarantee that they are safe but that they fulfil their function: to entertain the customer. In fact, one of the available services is a playroom with guided visits for families, where children can play… and try the products.

- The Institute also offers a comprehensive set of services to the Spanish toy industry and other related sectors, from the development of prototypes to mechanical and chemical trials, market studies, technical advice, graphic and industrial design, new technology applications, environmental and electronic management, industrial engineering and training. Additionally to the headquarters in Ibi, there is a trade delegation in Hong Kong and an office in France. And it is no coincidence that the European Union, the world’s second largest producer of toys after China, is also the main destination for Spanish toy exports, particularly Portugal and France and further afield, the United Kingdom, Germany and Italy. Outside of Europe, the United States has become the main customer of Spanish toy manufacturers, doubling its purchases in the last five years.

Information about the sector

- Spain is the world’s fourth largest producer of toys, and the third largest in the European Union.

- In total, and according to information from the trade association representing the sector, there are currently more than 180 toy manufacturers in Spain, where 9 out of 10 are small or medium size.

- The sector directly and indirectly employs 4,000 and 20,000 people respectively. 7.5% of the employees work in R&D.

- 66% of the companies export their products. External sales represent around 40% of turnover on average, but in some cases it is as high as 80%.

- Although during the economic recession some companies moved part of their production to China, an increase in transport costs and the dedication to quality has meant that production has partly returned to Spanish territory.

- Dolls, tricycles, scooters and pedal cars are the top export products.