In 1983, a highly successful video game called Bugaboo, also known in its various versions as The Flea, known as La Pulga in Spain, was published in the UK and later in the USA. It soon reached number one in the specialised games press. Created by two programmers from Extremadura, it is currently considered the first major milestone in the development of entertainment software in Spain, which is now one of the top 10 biggest players in the sector in the world and the fifth largest in Europe in terms of turnover.

La Pulga, which today gives its name to the Spanish national industry awards, was followed during the 1980s and early 1990s by other well-received productions such as Sir Fred, Livingstone Supongo (both in 1986), La Abadía del Crimen (1987, inspired by the film The Name of the Rose), Commandos, PC Fútbol and many more. All of them gave rise to what is known today as the ‘golden age’ of Spanish gaming, which ended in the early 1990s with the arrival of 16-bit technology.

A growing area of activity is that of serious games, which are being developed by around a quarter of Spanish companies in the sector. These are not intended for entertainment, but rather are designed for educational or training purposes

After a hiatus of a few years, with the turn of the century and the digital revolution, a resurgence began within the sector. In 2010, Castlevania: Lords of Shadow, developed by the Madrid-based studio MercurySteam, was released. The Japanese firm Konami selected them from a number of other American and Japanese proposals to redesign and revamp their product. The result was a mega-production with a budget of 20 million euros, which led to two sequels and became a worldwide critical and commercial success, marking a milestone for the sector in Spain. This is a sector that has experienced sustained growth over the last ten years, both in terms of turnover and business networks, although there is still a great deal of room for further expansion.

According to data from the Spanish video game development association DEV, in 2019, entertainment software production companies –some 400 in total, most of them small and concentrated mainly in Catalonia and Madrid, and to a lesser extent in Valencia and Andalusia– had a turnover of 920 million euros, 13% more than the previous year, 66% of which came from foreign sales. The fact that the main distribution channel is via global platforms on the Internet, mainly Steam, where 83% of Spanish studios make their sales, facilitates the process. According to DEV, physical sales account for only 4% of the total. North America (28%) and Europe (23%) are the main buyers of Spanish video games.

DEV forecasts annual turnover growth of 17% to EUR 1.7 billion by 2023. In terms of employment, the current workforce of just over 7,100 will rise to 8,500 direct jobs.

Indie games

In contrast to global and large-scale video games, the Spanish industry is characterised by the quality of its independent productions, which enjoy great international acclaim due to the originality of their game dynamics and aesthetics. Among the most recent, some of the most successful are Temtem known as the Spanish Pokémon, by Madrid-based studio Crema Games, which sold half a million units on Steam in its first month; or Blasphemous (2019), by The Game Kitchen from Seville, which mixes the folklore of southern Spain with action adventures and combat to the rhythm of guitar and saeta (a popular song typical of Easter), which has already reached one million players on Steam.

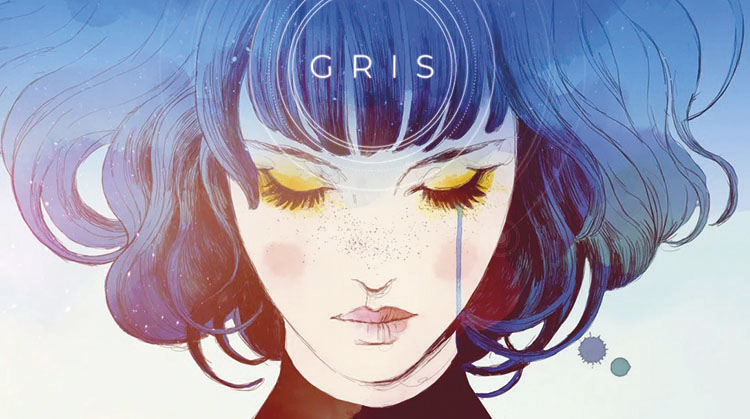

Among the best-selling, most-played and award-winning games of the last few years are They are billions, set in a zombie apocalypse designed by Madrid studio Numantian Games, which reached 15th place worldwide in January 2018 on Twitch; Gris, by Barcelona-based Nomada Studios, an intimate story with watercolour aesthetics, which received numerous awards and achieved an average rating of outstanding on the Steam platform; and The red strings club (2018), cyberpunk adventure game by Valencian studio Deconstructeam.

Esports: Beyond screens

League of Legends Smifinal, Vistalegre 2019. / PHOTO_RIOT GAMES

The video game sector’s growth is not only limited to software development, but also encompasses other activities with a high economic impact, such as esports: these are official and professional competitions for various battle and strategy video games, such as League of Legends (LoL), DOTA 2 (short for Defence of the Ancients 2), Fortnite, or Cs:Go (Counter-Strike: Global Offensive). All of them draw audiences numbering in the millions, not only online via streaming (live) on platforms such as Amazon-owned Twitch, but also, until the pandemic hit, face-to-face. That is to say, with audiences flocking to large venues to watch their favourite teams and players perform live. Spain has hosted some of these competitions, such as the 2018 final and the quarter and semi-finals of the League of Legends World Championship, held in November 2019 at the Palacio de Vistalegre in Madrid, which was attended by 8,000 live spectators, and another 1.7 million online during the two weeks of matches.

Esports in Spain generated 35 million euros in 2019, 22.5 million in advertising, which together with sponsorships are the main sources of revenue, according to the Spanish Video Game Association (AEVI). The sector employs 600 people, of which 250 are professional players, and Spain represents approximately 4% of the world’s esports economy, has 2.9 million fans –of which 55% are over 25 years old– and ranks 12th in the world in terms of esports audience share, which is mostly online, as well as having the highest percentage of female fans in Europe at 36%.