The Mexican airports of Guadalajara, Tijuana, Los Cabos, Puerto Vallarta, Guanajuato, Hermosillo, La Paz, Mexicali, Morelia, Aguascalientes, Los Mochis and Manzanillo, all operated by GAP (the Pacific Airport Group), have just updated their Master Plans to 2034. Ineco first began preparing these plans, which are structured in three five-year phases, in 2003, for the periods 2005-2019, 2010-2024 and 2015-2029.

Growing aviation market

In an aviation market as dynamic as that of Mexico, it is essential to adjust plans to anticipated levels of demand.

In the last five years alone, Mexican air traffic has skyrocketed –with year-on-year growth of more than 10% until 2019, when it grew by 8.4%– due to several factors: the 35% drop in ticket prices due to the trade war between airlines, the drop in fuel prices, the signing of 23 bilateral transport agreements in just four years and the strength of tourism. Within this context, GAP operates five of the 10 busiest airports in the country, with the list topped by Mexico City, with 50.3 million passengers in 2019, and Cancun, with 25.5 million. The Guadalajara airport, with 14.8 million passengers, is in third place.

Air traffic growth at all GAP airports over the past five years, at 12%, is higher than the national average (8%), which is attributable to several factors: the saturation of the international airport in the capital, Mexico City (AICM), which has benefited Guadalajara airport, the cross-border effect at Tijuana airport, and the increase in tourism at the Rivera Nayarit and La Paz airports, which has benefited the Puerto Vallarta and La Paz airports.

Guadalajara is the largest airport, Puerto Vallarta, Los Cabos the most touristic and Tijuana is the main gateway to the US

1 Guadalajara

The Guadalajara International Airport is the third most important in the country and is located in the state of Jalisco. Guadalajara is an important commercial, industrial and tourist centre. In line with the Master Plan, the main actions to be carried out in the coming years will be the construction of a second runway and a new terminal with its associated commercial apron. An increase in the capacity of the general aviation apron and the parking and access facilities is also proposed.

PHOTO_INECO + GAP

2 Tijuana

General Abelardo L. Rodríguez International Airport is located in Baja California, adjacent to the US border. Passengers departing from San Diego (USA) use the Cross Border Xpress (CBX), which allows them to cross the border without leaving the airport. The Tijuana Plan is currently underway, which includes the construction of a new processing building and the joining of the Alfa and Eco taxiways. The Master Plan aims, within the first five years, to reconfigure and expand the aircraft stands, as well as the security control area in the terminal building, and to reserve an area for cargo, in particular for CBX-Cargo. For the second five-year period, the construction of Dock C and a new control tower.

PHOTO_INECO + GAP

3 Los Cabos

The airport serves the Los Cabos area –comprised of the municipalities of San Jose del Cabo and Cabo San Lucas– currently one of the most important tourist destinations in the country. 70% of the traffic is international. Among the key actions, the Master Plan proposes, in the short term, to expand the commercial and general aprons, as well as the terminal buildings. For the second five-year period, land is being reserved in the medium term for the construction of a future second runway.

PHOTO_INECO + GAP

4 Puerto Vallarta

Located in the state of Jalisco, 7.5 kilometres northwest of the city of Puerto Vallarta. The main proposal of the Master Plan is the construction of a new terminal building with an associated apron, parking lots and roads, as well as a reform of the current terminal building.

PHOTO_INECO + GAP

5 Guanajuato

Located in the municipality of Silao (Guanajuato). With 2.7 million passengers in 2019, Guanajuato is the fifth largest city within GAP. In the last five years, average growth has been spectacular, at 15.5%, above the average of 12.1% for GAP. Commercial traffic is mostly domestic. The proposed development includes an expansion in several phases of different areas of the terminal building (departures, arrivals, baggage claim, new boarding gates), as well as the parking aprons (commercial and general aviation).

PHOTO_INECO + GAP

6 Hermosillo

The airport is located in the municipality of Hermosillo, in the state of Sonora. It serves as an alternate airport to Tijuana. The main development proposals include the enlargement and reconfiguration, over several phases, of the stands on the general aviation apron and, in the short term, of the passenger and baggage claim areas. Also, the control tower is to be renovated, although it does not need to be relocated.

PHOTO_INECO + GAP

7 La Paz

The General Manuel Márquez de León International Airport is located in the state of Baja California Sur. Almost 100% of passenger traffic and commercial operations are domestic. The Master Plan recommends, among other actions, the enlargement of customs, phytosanitary and documentation controls, in the short term; or, in the medium term, of the terminal building, the final waiting room and baggage claim.

PHOTO_INECO + GAP

8 Mexicali

The General Rodolfo Sánchez Taboada International Airport is located in the state of Baja California, about 6.5 kilometres from the US border. Short-term development proposals include increasing the number of documentation counters, installing an X-ray machine and remodelling the general aviation building.

PHOTO_INECO + GAP

9 Morelia

The airport is located 30 kilometres from the city of Morelia, in the north of the state of Michoacán. Following an analysis of demand, it was concluded that the airfield has sufficient capacity for the entire reference period. In the short term, proposed actions include, among others, the expansion of the general aviation apron, as well as the areas for document control, boarding and baggage claim rooms.

PHOTO_INECO + GAP

10 Aguascalientes

The Licenciado Jesús Terán Peredo International Airport is located 24 kilometres south of the city of Aguascalientes. Over the last five years, the average annual growth rate of commercial passengers has been 13.9%, well above the figures reported for the entire group. Among the actions of the Master Plan, it is worth highlighting that during the first five years, the commercial and general aprons were enlarged and remodelled, as well as the passenger area, in particular for baggage claim and document control, and some repairs were made to the beacon in the control tower.

PHOTO_INECO + GAP

11 Los Mochis

The Valle del Fuerte International Airport, or Los Mochis, is located in the state of Sinaloa. Its traffic is almost 100% domestic. The proximity of the airports of Hermosillo and Culiacán –both state capitals– results in competition that affects primarily the development of international traffic. As for the Master Plan, it proposes the remodeling and expansion of the south-west and south-east facades of the existing terminal building, the expansion of the general aviation apron and the reconfiguration of the current seating arrangements.

PHOTO_INECO + GAP

12 Manzanillo

Also known as Playa de Oro, it is located in the west of the state of Colima. The distribution of commercial passengers is very balanced: 55% of the traffic is domestic and 45% international. No need to increase the capacity of the runway and the commercial aviation apron over the entire time frame of the study was identified. For the terminal building, the expansion and remodeling of the medical clinics, security controls, waiting room and baggage claim area are proposed.

PHOTO_INECO + GAP

GAP, Mexico’s leading operator

GAP passenger growth 2019 vs 2018

SOURCE_GAP FORECASTS AS OF JANUARY 2020

WHAT IS A MASTER PLAN?

A Master Plan is the document that constitutes the main planning tool for the development of an airport and governs its development over different time frames. It takes into account its geographical and socio-economic environment, based on the current situation. Since traffic and expected demand are constantly evolving due to multiple factors, they need to be updated regularly. Master Plans involve two distinct planning figures:

- ‘Proposed development’, which includes the necessary works to adapt airport capacity to foreseeable demand in the short, medium and long term. Works are planned so that they are ready when needed, and are distributed over three five-year periods between 2020 and 2034 (five-year periods).

- From the final year, 2034, the ‘maximum possible development’, considers a longer time frame, with the aim of defining a ‘reserve area’ for the future development of the airport.

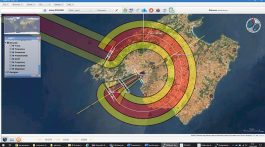

Within the ‘proposed development’, all plans include an aeronautical easement study, a section on environmental measures, the noise footprint of each airport, a preventive maintenance plan for the facilities, an accessibility study in accordance with Mexican legislation, and a proposal for tariffs calculated on the traffic units.